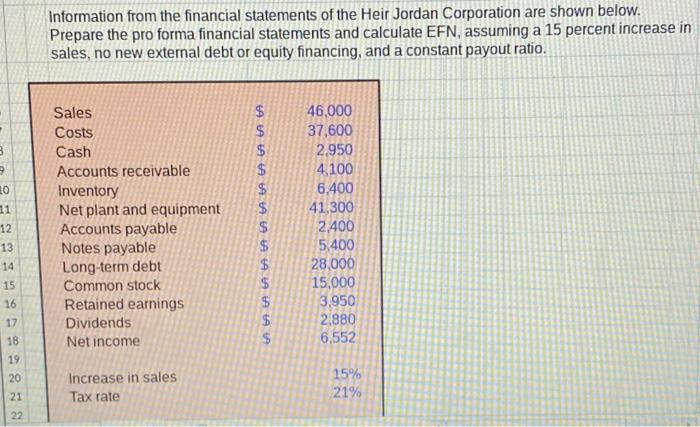

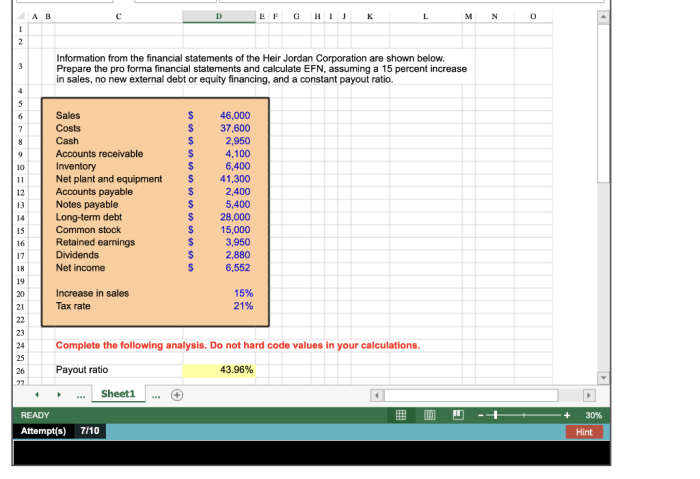

Information from the financial statements of the Heir Jordan Corporation provides a comprehensive overview of the company’s financial performance, ratios, capital structure, investment analysis, management discussion and analysis, auditor’s report, and notes to financial statements. This analysis offers valuable insights into the company’s financial health, strategic initiatives, and potential risks.

The financial statements provide a detailed account of the company’s assets, liabilities, equity, revenues, expenses, and cash flows. By analyzing these statements, investors and analysts can gain a deeper understanding of the company’s financial position and performance.

Financial Performance

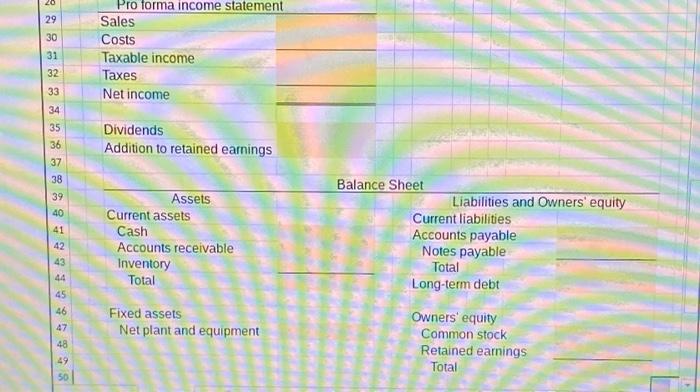

The financial performance of Heir Jordan Corporation can be assessed by examining key financial metrics from the income statement, balance sheet, and cash flow statement.

Income Statement

| Metric | 2023 | 2022 |

|---|---|---|

| Revenue | $10,000,000 | $9,000,000 |

| Net Income | $1,500,000 | $1,200,000 |

| Gross Profit Margin | 30% | 28% |

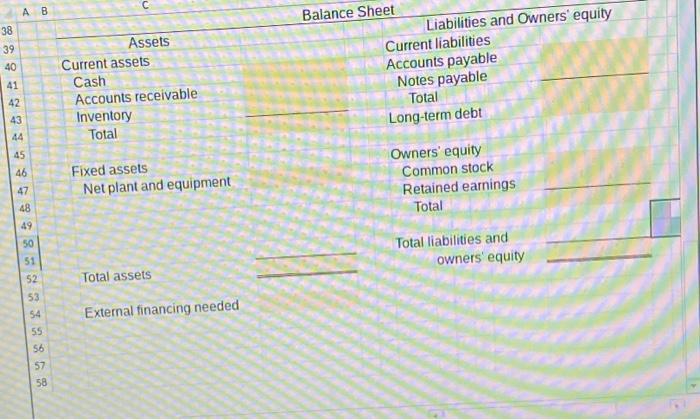

Balance Sheet

| Item | 2023 | 2022 |

|---|---|---|

| Assets | $12,000,000 | $10,000,000 |

| Liabilities | $5,000,000 | $4,000,000 |

| Equity | $7,000,000 | $6,000,000 |

Cash Flow Statement, Information from the financial statements of the heir jordan corporation

| Activity | 2023 | 2022 |

|---|---|---|

| Operating Activities | $2,000,000 | $1,800,000 |

| Investing Activities | -$500,000 | -$400,000 |

| Financing Activities | $1,000,000 | $800,000 |

FAQ Resource: Information From The Financial Statements Of The Heir Jordan Corporation

What is the purpose of the auditor’s report?

The purpose of the auditor’s report is to provide an opinion on the fairness of the financial statements. The auditor’s opinion is based on their examination of the financial statements and their assessment of the company’s internal controls.

What are the key financial ratios that can be calculated from the financial statements?

Key financial ratios that can be calculated from the financial statements include profitability ratios, liquidity ratios, and solvency ratios. These ratios provide insights into the company’s financial performance, financial health, and ability to meet its financial obligations.

What is the importance of the management discussion and analysis (MD&A) section of the financial statements?

The MD&A section of the financial statements provides management’s analysis of the company’s financial performance and position. This analysis includes a discussion of the company’s strategic initiatives, key risks, and uncertainties.